Energy Storage Valuation: A Review of Use Cases and Modeling

General Cost and Performance Parameters for Energy Storage Technologies......................................... 8 Introduction

Financial Models for Renewable Energies

Unlock the power of Renewable Energy Sources with our meticulously crafted financial models. Explore strategic insights to drive sustainable investments.

LAZARD''S LEVELIZED COST OF STORAGE

Here and throughout this presentation, unless otherwise indicated, analysis assumes a capital structure consisting of 20% debt at an 8% interest rate and 80% equity at a 12% cost of equity.

Energy storage financial forecasting Model Excel Template

This Energy Storage Financial Forecasting Excel Model allows users to build detailed 50-year financial projections across monthly and yearly timelines, making it ideal for

Battery Energy Storage System Production Cost

Case Study on Battery Energy Storage System Production: A comprehensive financial model for the plant''s setup, manufacturing, machinery and operations.

Energy Storage Financial Model in Excel [Updated

Our ready-made Energy Storage financial model in Excel alleviates numerous financial pain points for users, offering a comprehensive

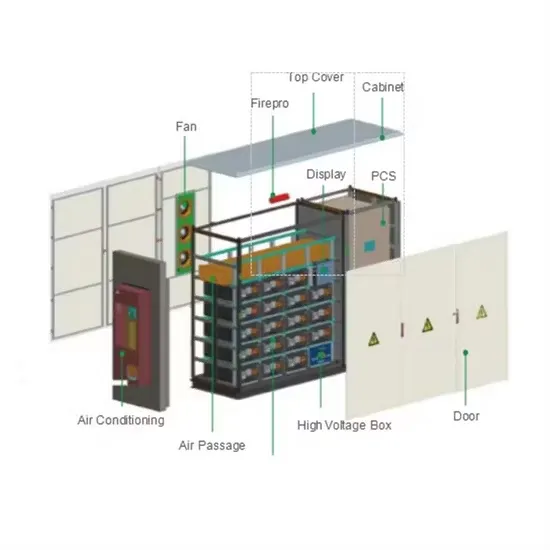

White paper BATTERY ENERGY STORAGE SYSTEMS

Introduction Sustainable energy systems based on fluctuating renewable energy sources require storage technologies for stabilising grids and for shifting renewable production to match

Energy Storage Financial Model Analysis: Key Trends and

The global energy storage market is projected to balloon to $490 billion by 2032 [1], making it the ultimate playground for investors and engineers alike. But how do you

Economic and financial appraisal of novel large-scale energy storage

This paper presents and applies a state-of-the-art model to compare the economics and financial merits for GIES (with pumped-heat energy storage) and non-GIES

Energy Storage Financial Model

Fractal provides robust energy storage financial models to utilities, energy companies and investors. Fractal has spent years developing and optimizing powerful models

Energy Storage Analysis

Energy storage analysis assesses market relevance and competitiveness for hydrogen. Analysis assesses hydrogen system competitive space and valuation in the landscape of energy

StoreFAST: Storage Financial Analysis Scenario Tool

The Storage Financial Analysis Scenario Tool (StoreFAST) model enables techno-economic analysis of energy storage technologies in service of grid-scale energy

Systems Analysis | Hydrogen and Fuel Cells | NREL

Systems Analysis NREL''s hydrogen systems analysis activities provide direction, insight, and support for the development, demonstration, and deployment of a broad range of hydrogen

Proforma Financial Model of BESS – Acelerex

A well-structured proforma financial model provides a clear picture of the economic feasibility of a BESS project. By accurately forecasting revenues, evaluating costs, and applying key financial

Energy Systems Analysis Data and Tools

Energy Systems Analysis Data and Tools Explore our free data and tools for assessing, analyzing, optimizing, and modeling technologies. Search or sort the table below to

Modeling Financial Feasibility of Energy Storage

Financial modeling frameworks are employed to assess key parameters such as capital expenditure, operational costs, energy storage capacity, lifespan, and market demand. These

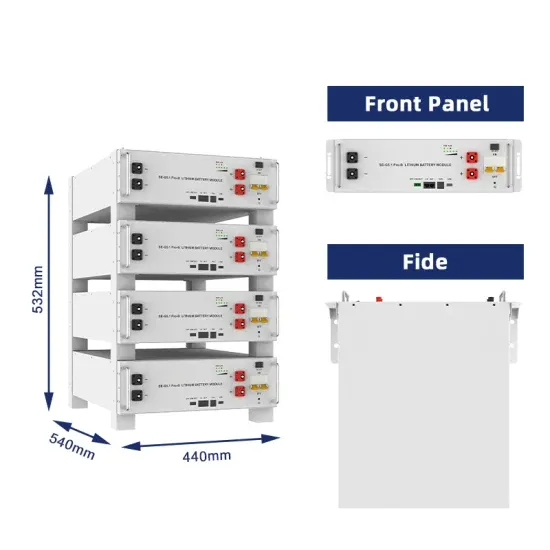

Battery Energy Storage System (BESS)

Financial Model providing a dynamic up to 10-year financial forecast for the development of a Green Filed Battery Energy Storage System (BESS) Facility.

Battery as Merchant Peaker – Edward Bodmer –

The model I am using is a simplistic evaluation of whether battery storage is beneficial in the provision of a data center that uses a whole lot of energy and would like to use as much renewable energy as possible as long as it is

Business Models and Profitability of Energy Storage

Our goal is to give an overview of the profitability of business models for energy storage, showing which business model performed by a certain technology has been examined

Energy Storage Financial Model in Excel [Updated

Our ready-made Energy Storage financial model in Excel alleviates numerous financial pain points for users, offering a comprehensive solution for Energy Storage investment analysis, ROI calculation, and project

H2FAST: Hydrogen Financial Analysis Scenario Tool

The Hydrogen Financial Analysis Scenario Tool, H2FAST, provides a quick and convenient in-depth financial analysis for hydrogen and nonhydrogen systems and services. H2FAST is available as a

Energy Storage: Connecting India to Clean Power on

Executive Summary The rapid expansion of renewable energy has both highlighted its deficiencies, such as intermittent supply, and the pressing need for grid-scale energy storage

Economic Analysis of Battery Energy Storage Systems

The recent advances in battery technology and reductions in battery costs have brought battery energy storage systems (BESS) to the point of becoming increasingly cost-.

Energy Storage Financing: Project and Portfolio Valuation

ABSTRACT This study investigates the issues and challenges surrounding energy storage project and portfolio valuation and provide insights into improving visibility into the process for

Evaluating energy storage tech revenue potential

While energy storage is already being deployed to support grids across major power markets, new McKinsey analysis suggests investors often underestimate the value of energy storage in their

Storage Futures Study: Storage Technology Modeling Input

The SFS series provides data and analysis in support of the U.S. Department of Energy''s Energy Storage Grand Challenge, a comprehensive program to accelerate the development,

Energy Storage Financial Modeling Insights

Energy Storage System Financial Modeling: A Comprehensive Guide In an era where sustainable energy and smart infrastructure are at the forefront of technological advancements, financial

Energy Modeling Tools

OpenStudio® is a cross-platform (Windows, Mac, and Linux) collection of software tools to support whole building energy modeling using EnergyPlus and advanced daylight analysis

Energy Storage Grand Challenge Energy Storage Market

This data-driven assessment of the current status of energy storage markets is essential to track progress toward the goals described in the Energy Storage Grand Challenge and inform the

Storage Futures | Energy Systems Analysis | NREL

Technical Report: Moving Beyond 4-Hour Li-Ion Batteries: Challenges and Opportunities for Long (er)-Duration Energy Storage This report is a continuation of the

(PDF) Economic Analysis of the Investments in Battery Energy Storage

This study provides the review of the state-of-the-art in the literature on the economic analysis of battery energy storage systems.

You might like this video

Related Contents

- Gaogong energy storage financial analysis report epc

- 2022 energy storage industry analysis report

- Long cycle energy storage battery field analysis report

- Energy storage system cost analysis report template

- Energy storage industry analysis report 2012

- German energy storage field policy analysis report