Profit Analysis in Energy Storage: Trends, Challenges, and Real

That''s essentially what happens on a global scale with energy grids – except the stakes are much higher. Energy storage profitability analysis has become the holy grail for

Energy Storage Technologies for Modern Power Systems: A

Power systems are undergoing a significant transformation around the globe. Renewable energy sources (RES) are replacing their conventional counterparts, leading to a

Business Models and Profitability of Energy Storage

Here we first present a conceptual framework to characterize business models of energy storage and systematically differentiate investment opportunities.

profit analysis of mobile energy storage power supply equipment

Abstract: In order to promote the deployment of large-scale energy storage power stations in the power grid, the paper analyzes the economics of energy storage power stations

How much is the profit of energy storage power station

The profit from constructing an energy storage power station varies significantly based on several factors. 1. Initial investment is substantial, often ranging from millions to

Profit Analysis and Power Storage Investment: A 2025 Guide for

Power Storage Investment Trends That''ll Make Your Head Spin 2025''s energy storage market is like a Tesla battery fire – hot, unpredictable, and full of potential. The global

Application of Mobile Energy Storage for Enhancing Power

Compared to stationary batteries and other energy storage systems, their mobility provides operational flexibility to support geo-graphically dispersed loads across an outage area. This

What Profit Analysis Does Energy Storage Include? A 2025 Deep

Let''s crack open the profit pizza of energy storage - where every slice represents a different revenue stream. From California''s solar farms to Guangdong''s factories, energy

How much profit does portable energy storage power supply have

With the demand for energy storage systems rising, fluctuations in the price of materials can substantially impact profit margins. Additionally, advancements in technology

How is the profit of factory energy storage power supply

The profitability of factory energy storage power supply can be effectively analyzed through various facets. 1. Profit margins play a crucial role, considering the initial

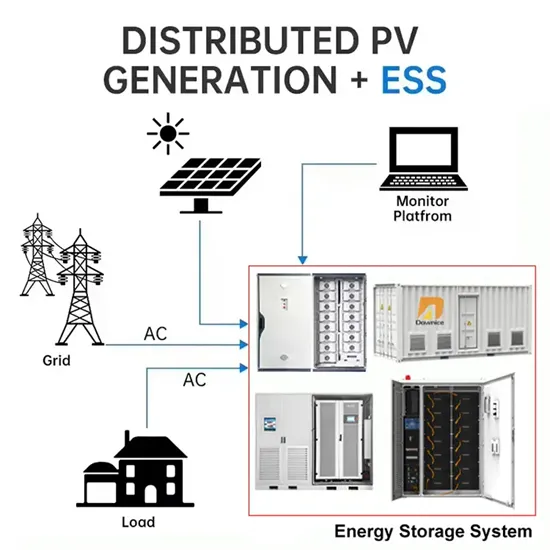

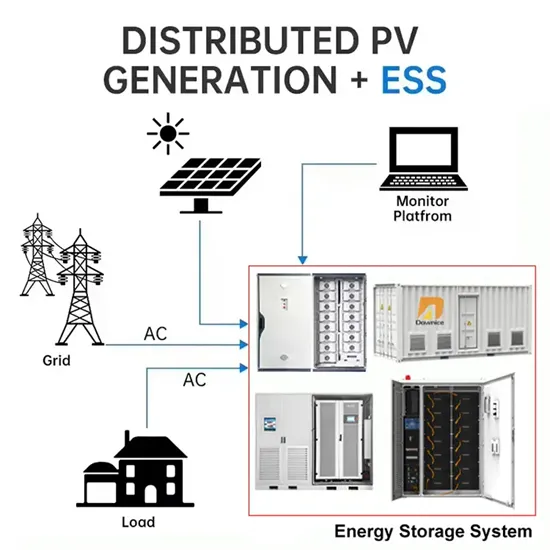

Overview on hybrid solar photovoltaic-electrical energy storage

This study provides an insight of the current development, research scope and design optimization of hybrid photovoltaic-electrical energy storage systems for power supply

2022 Grid Energy Storage Technology Cost and Performance

The Department of Energy''s (DOE) Energy Storage Grand Challenge (ESGC) is a comprehensive program to accelerate the development, commercialization, and utilization of next-generation

Research on optimal configuration of mobile energy storage in

State Grid Anshan Electric Power Supply Company, Anshan, China The increasing integration of renewable energy sources such as wind and solar into the distribution

Technologies and economics of electric energy storages in power

As fossil fuel generation is progressively replaced with intermittent and less predictable renewable energy generation to decarbonize the power system, Electrical energy

碳中和目标下移动式储能系统关键技术

The mobile energy storage system with high flexibility, strong adaptability and low cost will be an important way to improve new energy consumption and ensure power supply.

Profit analysis of energy storage scientific research

Although academic analysis finds that business models for energy storage are largely unprofitable,annual deployment of storage capacity is globally on the rise (IEA,2020). One

The best profit analysis of power storage

The European power system needs to develop mechanisms to compensate for the reduced predictability and high variability that occur when integrating renewable energy. Construction of

How is the profit of energy storage battery assembly?

1. The profitability of energy storage battery assembly is influenced by several critical factors: 1) Market Demand, 2) Production Costs, 3) Technological Advancements, 4)

Evaluating energy storage tech revenue potential

Across all these opportunities, the actual revenue potential of energy storage assets will depend on the local context: power market conditions in the country, storage-specific regulations and incentives,

Economic scheduling of mobile energy storage in distribution

Compared with traditional stationary energy storage system (SESS), mobile energy storage system (MESS) has power transfer ability in both spatial and temporal

2022 Grid Energy Storage Technology Cost and

The Department of Energy''s (DOE) Energy Storage Grand Challenge (ESGC) is a comprehensive program to accelerate the development, commercialization, and utilization of next-generation energy storage

Battery Energy Storage Systems Report

This information was prepared as an account of work sponsored by an agency of the U.S. Government. Neither the U.S. Government nor any agency thereof, nor any of their employees,

Mobile Energy Storage: Power on the Go

In an era increasingly dependent on portable technology and renewable energy, mobile energy storage solutions have emerged as a transformative development. This article

Portable Power Station Market Size | Industry

The global portable power station market size was estimated at USD 0.69 billion in 2024 and is projected to reach USD 1.74 billion by 2030, growing at a CAGR of 17.0% from 2025 to 2030. The increasing demand for clean,

Evaluating energy storage tech revenue potential

While energy storage is already being deployed to support grids across major power markets, new McKinsey analysis suggests investors often underestimate the value of energy storage in their

Economic Benefit Analysis of Mobile Energy Storage Based on

Through a careful review of the full life cycle costs and benefits associated with mobile energy storage, a financial operating objective function is developed, and model parsing

Mobile energy storage systems with spatial–temporal flexibility for

Through the research of this paper and the analysis of cases, the following conclusions can be drawn: (1) The spatial–temporal flexibility of the mobile energy storage

Business Models and Profitability of Energy Storage

Building upon both strands of work, we propose to characterize business models of energy storage as the combination of an application of storage with the revenue

Planning of Stationary-Mobile Integrated Battery Energy Storage

Under extreme weather events represented by severe convective weather (SCW), the adaptability of power system and service restoration have become paramount. To this end, this paper

Research on optimal configuration of mobile

State Grid Anshan Electric Power Supply Company, Anshan, China The increasing integration of renewable energy sources such as wind and solar into the distribution grid introduces new complexities

Impact of Energy Storage Systems on the Operation of Electricity Supply

The main prospects for the application of energy storage systems in high-voltage power supply networks are examined. An analysis of the impact of energy storage systems on the

Profit Analysis of the Energy Storage Industry: Where Batteries

Let''s cut to the chase: the global energy storage market is currently a $33 billion powerhouse, churning out nearly 100 gigawatt-hours of electricity annually [1]. But here''s the kicker –

You might like this video

6 FAQs about [Profit analysis of mobile energy storage power supply]

How do business models of energy storage work?

Building upon both strands of work, we propose to characterize business models of energy storage as the combination of an application of storage with the revenue stream earned from the operation and the market role of the investor.

Is energy storage a profitable business model?

Although academic analysis finds that business models for energy storage are largely unprofitable, annual deployment of storage capacity is globally on the rise (IEA, 2020). One reason may be generous subsidy support and non-financial drivers like a first-mover advantage (Wood Mackenzie, 2019).

Do investors underestimate the value of energy storage?

While energy storage is already being deployed to support grids across major power markets, new McKinsey analysis suggests investors often underestimate the value of energy storage in their business cases.

How can energy storage be profitable?

Where a profitable application of energy storage requires saving of costs or deferral of investments, direct mechanisms, such as subsidies and rebates, will be effective. For applications dependent on price arbitrage, the existence and access to variable market prices are essential.

How do I evaluate potential revenue streams from energy storage assets?

Evaluating potential revenue streams from flexible assets, such as energy storage systems, is not simple. Investors need to consider the various value pools available to a storage asset, including wholesale, grid services, and capacity markets, as well as the inherent volatility of the prices of each (see sidebar, “Glossary”).

How would a storage facility exploit differences in power prices?

In application (8), the owner of a storage facility would seize the opportunity to exploit differences in power prices by selling electricity when prices are high and buying energy when prices are low.

Related Contents

- Energy storage power supply profit analysis code

- Analysis method of energy storage mobile power supply

- Energy storage mobile power supply equipment

- Indian mobile energy storage power supply spot

- Mobile energy storage power supply vehicle explanation

- Muscat mobile energy storage power supply field quote